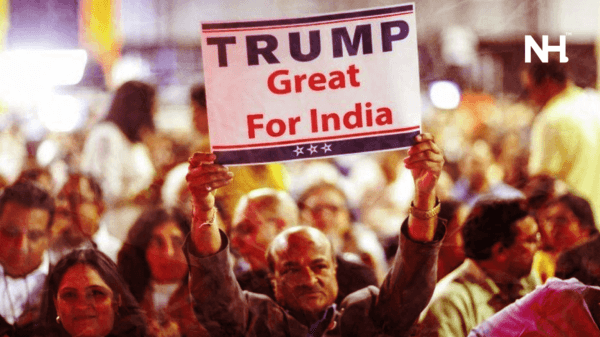

Recently, a post went viral comparing taxes levied by Manmohan Singh-led UPA government and Narendra Modi-led NDA government. The post claimed that the latter had imposed much lower taxes under the GST.

The image was shared by BJP’s Mahila Morcha social media chief Priti Gandhi. Gandhi wrote that the opposition had misled the masses, as the tax rates under ‘economist’ PM Manomahan Singh were way higher than the ones levied by the current government.

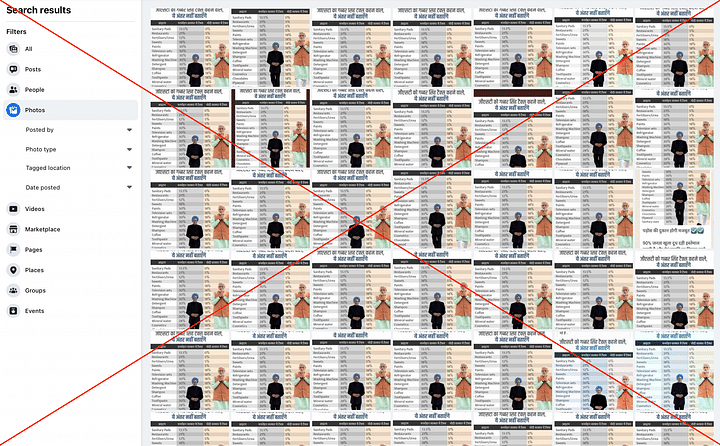

The claim is viral across social media with the following declaration: “Those who call GST as Gabbar Singh Tax will not tell the difference. They will only mislead the public.” BJP’s Delhi spokesperson Anuja Kapur also tweeted the graphic with the same claim.

Don't get misled by the fake propaganda of the opposition, just compare the taxes levied on essentials during "Economist" Manmohan Singh's tenure & Pradhan Sevak @narendramodi's!! pic.twitter.com/OoFa4wzmgT

— Priti Gandhi – प्रीति गांधी (@MrsGandhi) July 19, 2022

जीएसटी को गब्बर सिंह टैक्स कहने वाले, ये अंतर नही बताएंगे।

सिर्फ जनता को गुमराह करेंगे। pic.twitter.com/WybkbbnZy9

— Anuja Kapur (@anujakapurindia) July 20, 2022

जीएसटी को गब्बर सिंह टैक्स कहने वाले, ये अंतर नही बताएंगे।

सिर्फ जनता को गुमराह करेंगे। pic.twitter.com/9LM2sGFYom

— chandan Raj (@Chandankumar009) July 20, 2022

But before we debunk myths, it is important to understand the GST regime and the VAT(value added tax) regime that existed before GST was rolled out.

VAT was introduced on April 1, 2005. It is an indirect tax levied on goods and services for value added at every point of the production or distribution cycle. Every state had different rules for VAT’s implementation and hence the rates levied by each state were also different.

On the contrary GST, which was launched in 2017, is a consumption-based tax. This means that goods and services are taxed when they reach their destination. Furthermore, the GST imposes a uniform tax rate across the country- divided into the centre’s share (CGST) and the states’ share (SGST).

Credits: The Quint

As per a document found on the website of the Central Board of Excise and Customs, the GST levied on curd and lassi has been reduced from 4% (the pre-GST rate) to 0%. Similarly, the rates for rice (previously taxed 2.75%), wheat (previously taxed 2.5%), flour (previously taxed 3.5%), and honey (previously taxed 6%) have been reduced to 0% under the GST.

However, the government has recently raised the GST for rice, wheat, flour, lassi, curd, and paneer to 5%. Furthermore, even unbranded products sold under this category would attract GST.

Also,the services industry has been negatively impacted by a hiked GST rate. Prices of many services have increased as they were charged 15% service tax in the pre-GST period, whereas they are charged 18% GST now.

Under GST, while the taxation rates of some products have reduced, rates of other products have been volatile. Last but not the least, comparing GST and VAT on different goods and services is illogical owing to the fact that VAT rates varied across states. Hence, the viral claim is misleading.

References: The Logical Indian, The Quint

Featured Image Source: Mint