The election in the world’s largest democracy is a season for many Ups and Downs not just in the Political Sphere but also in the Financial Sphere. The 2024 Lok Sabha Election will affect the Stock Market like any other election through the years has, however the magnitude will considerably vary. Let us find out Why and by How much.

Source: Business Today

Full Story:

Analyzing four election cycles spanning over 20 years, a study pointed out that during each of these periods, investors have consistently achieved above-average returns, whether preceding or following the announcement of election results.

Moreover, the data indicates that even within a minimum investment timeframe of one year, investors have experienced significant gains. Therefore, it recommends that investors maintain their positions in the market, regardless of volatility, and remain unfazed by election-related news or rumors.

The study informed that in 2019, the Nifty50 posted 10.7 percent returns in 6 months before the elections and just 2.2 percent returns in the 6 months after the elections. The same trend has been in 2014, 2009, and 2004 as well. Nifty returns before the elections have been higher than that post elections. In 2014 as well, Nifty rose 18.9 percent in 6 months before the elections and 16.4 percent post-elections.

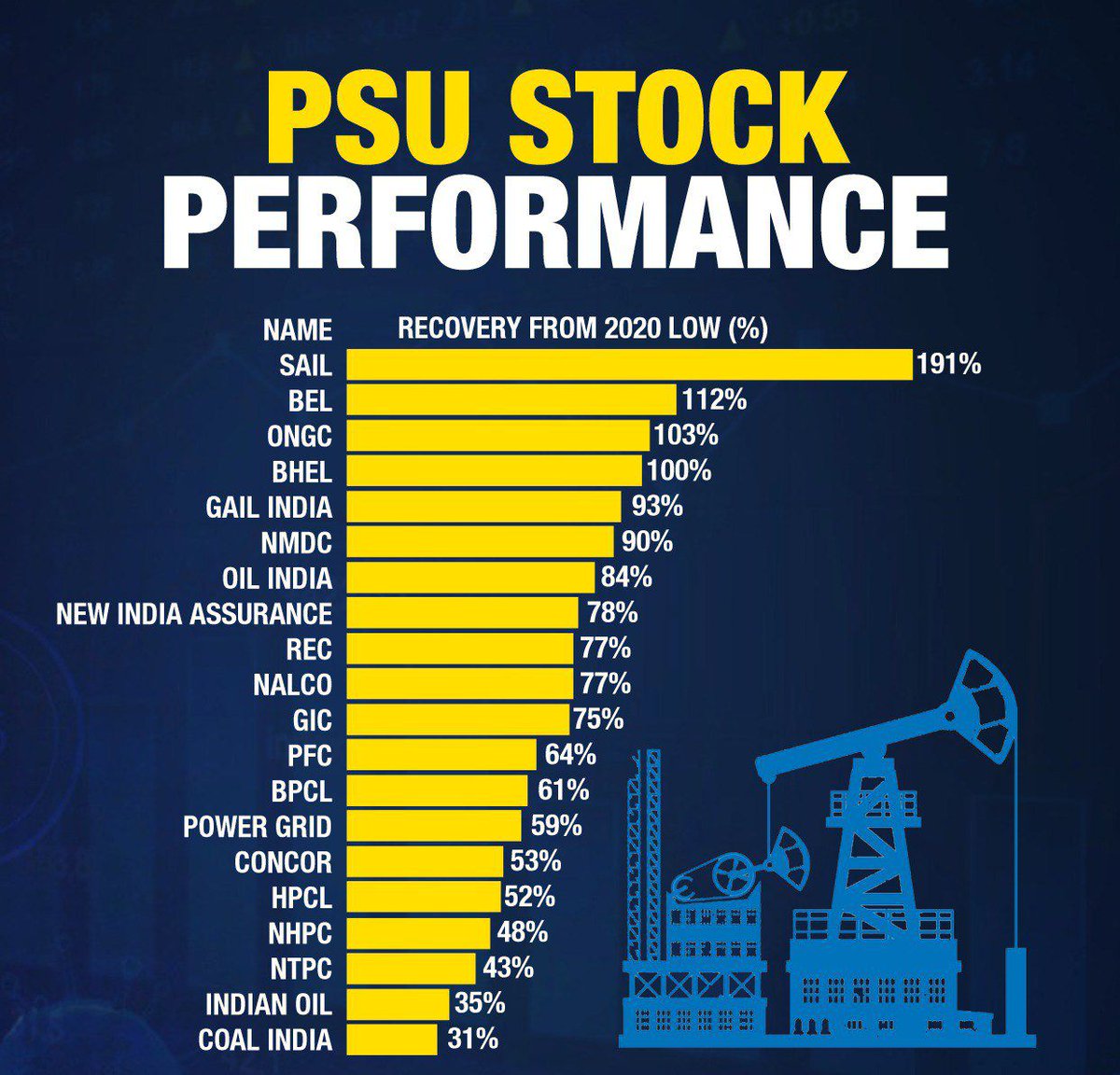

According to the report, Public Sector Undertakings (PSUs) have demonstrated strong performance recently, making PSU stocks worthy of attention due to their increased profitability. In 2023, the Nifty PSE index surged by 77 percent, outpacing the Nifty 50’s return of 20 percent. Even in 2024, the PSE index has delivered a return of 21 percent, compared to the Nifty 50’s return of 3 percent. This performance suggests the potential for further gains, particularly given the low valuations, with the Nifty PSE index still trading at a PE ratio of 10.

Source: R.K on “X”

Additionally, public sector indices including the Nifty PSE, Nifty CPSE, and Nifty PSU Bank have all surpassed major Indian indices over the past year. This trend indicates a growing belief in public sector undertakings within the country, which is contributing to the overall strength of the market.

This Bullish Trend toward the PSU might continue if the Government in Power has a stable Majority however if the opposite were to happen, that would result in a disaster for the stock market with panic selling and crashing stocks. This year’s elections are not only bringing excitement to the politicians but also to the investors who will be looking to make huge profits.

Read Also:

Interim Budget Of The Year 2024-25 | Key Highlights And Initiatives