After Adani Group, shares of the digital payment company run by former Twitter CEO Jack Dorsey, Block, plummeted on Thursday after short-seller Hindenburg Research revealed that it facilitates fraud against consumers and the government, avoids regulation, presents predatory loans and fees as ground-breaking technology, and deceives investors with exaggerated metrics.

Block, formerly known as Square, is a $44 billion market value firm to empower the “unbanked” and the “underbanked” and claims to have created a “frictionless” and “magical” financial technology.

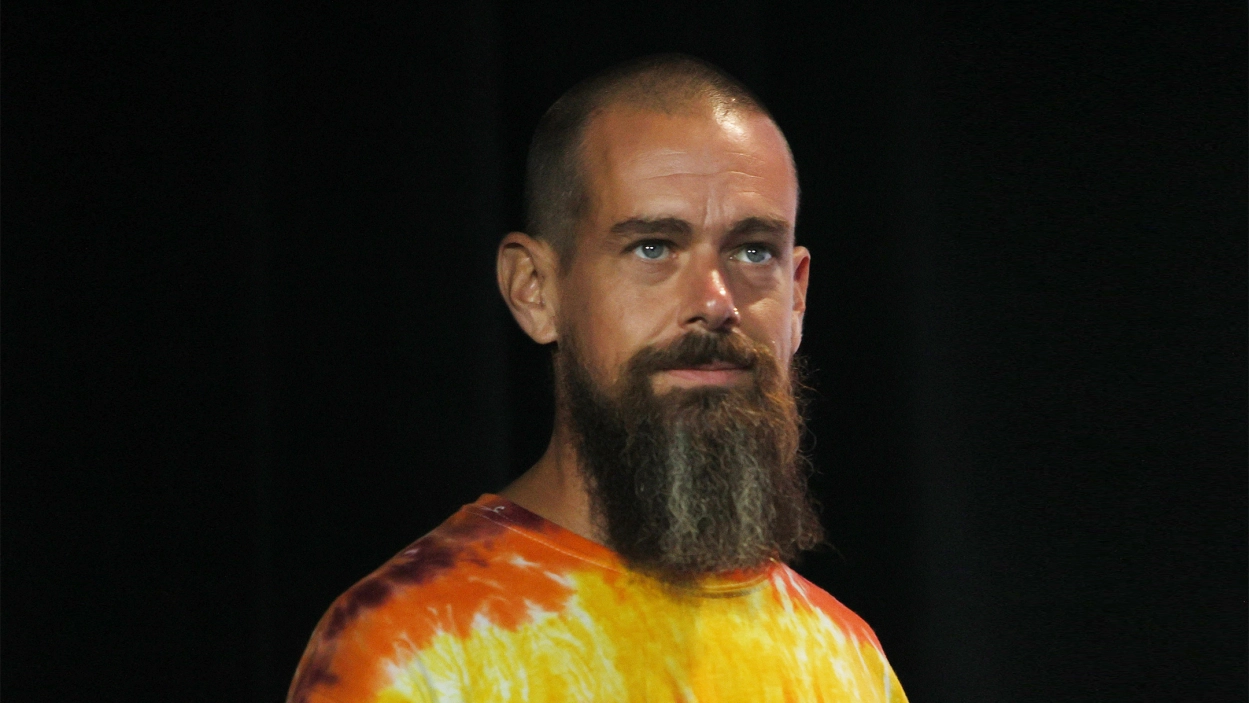

Jack Dorsey

Image Source: Britannica

The Hindenburg report said, “Our 2-year investigation has concluded that Block has systematically taken advantage of the demographics it claims to be helping.” It added, “We also believe Jack Dorsey has built an empire — and amassed a $5 billion personal fortune — professing to care deeply about the demographics he is taking advantage of.”

Most analysts were enthusiastic about Block’s Cash App platform’s post-pandemic boom. They anticipated that its 51 million monthly active users who transact would fuel high-margin growth and serve as a future platform for launching new products.

Image Source: Deccan Herald

The Hindenburg report said, “Our research indicates, however, that Block has wildly overstated its genuine user counts and has understated its customer acquisition costs.”

According to the report, former employees believed that 40% and 75% of the accounts they assessed were fraudulent, phoney, or extra accounts connected to a single person. Block embraced a group of people that have historically been severely “underbanked”: criminals.

Hindenburg said, “The company’s ‘Wild West’ approach to compliance made it easy for bad actors to mass-create accounts for identity fraud and other scams, then extract stolen funds quickly.”

Block blacklisted the account without banning users even after they were discovered committing fraud or other illegal activities.

Block INC

Image Source: Business Upturn

An ex-customer service agent shared screenshots demonstrating how blacklisted accounts were frequently linked to dozens or hundreds of other active accounts that were thought fraudulent.

This phenomenon of allowing blacklisted users were so familiar that rappers bragged about it in hip-hop songs. Cash App’s Founder, Jack Dorsey, has publicly bragged about how many hip-hop songs have references to it as proof of its popularity.

The Hindenburg report added, “A review of those songs show that the artists are not generally rapping about Cash App’s smooth user interface — many describe using it to scam, traffic drugs or even pay for murder.”

Cash App was also cited “by far” as the top app used in reported US sex trafficking, according to a leading non-profit organisation. Cash App is used to support sex trafficking, including the trafficking of kids, according to numerous Department of Justice reports.

Image Source: Wikipedia

According to several interviews with former employees, the network has been inundated with fraudulent accounts, false users, and supporting funds for unlawful acts. Block’s $29 billion deal to acquire a buy now pay later (BNPL) service Afterpay closed in January 2022.

The report mentioned, “The acquisition is flopping. In 2022, the year Afterpay was acquired, it lost $357 million, accelerating from 2021 losses of $184 million.”

In conclusion, Hindenburg says, “we think Block has misled investors on key metrics and embraced predatory offerings and compliance worst-practices to fuel growth and profit from facilitation of fraud against consumers and the government.”

Block or Dorsey was yet to reach the Hindenburg report.