The Central Board of Direct Taxes has released a final warning for people to link their PAN card with Aadhar. The government of India has set the 31st of March as the deadline for all taxpayers in the country. The Income-tax Department has made it mandatory for all to link their PAN and Aadhar to solve the question regarding the duplication of PANs.

The Indian Income Tax Department has identified cases where an individual holds multiple PAN cards, or one PAN card is allotted to several people. This has caused discrepancies to identify and track the taxpayers. To eliminate the duplicated PANs, the government urged the people to link them to their Aadhaar for more accuracy.

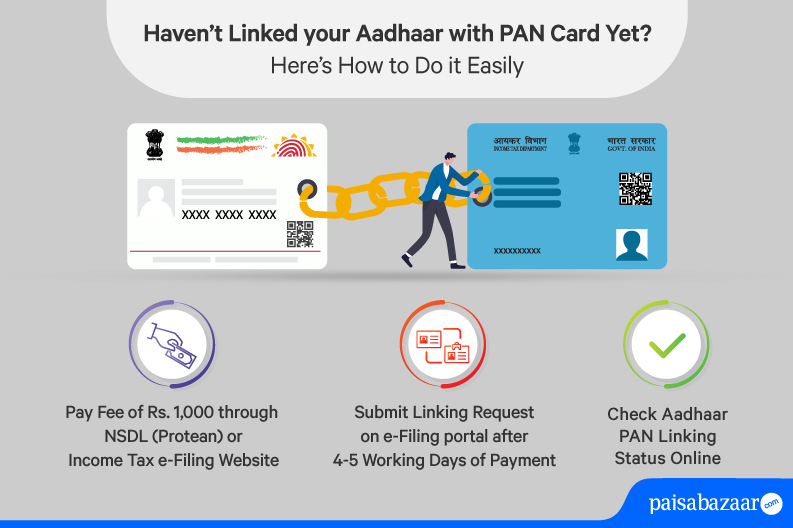

Credits – Paisabazaar.com

Citizens of age 80 years and above, non-residents as per the Income-tax Act, and people who are not citizens of India but living in the country are exempted from the Aadhaar-PAN linking.

The linking of PAN cards with Aadhaar will help the government track down tax evasion, ensure compliance with tax laws and also verify the identity of taxpayers. The Income-tax Department and the government of India are aiming at increasing the efficiency of the tax system through this activity.

Credits – Business Insider

If an eligible taxpayer is unable to link their Aadhar to the PAN, the following would be the consequences:

- PAN will become invalid – The failure in linking your PAN with your Aadhaar will deem the PAN invalid, which will make the person unable to use it for financial transactions.

- Losing out on Tax benefits – The invalidity of the PAN would mean that the individual would not be able to utilise the benefits of the government’s tax benefits such as deductions, credits, and even exemptions.

- Difficulty in opening a bank account – PAN card is an important measure required for opening an account in the bank. Thus not having a valid PAN card would make it tougher for the individual to open a bank account.

How to Link PAN with Aadhaar?

To link Aadhaar with PAN-

– Visit the Income Tax e-Filing portal- incometaxindiaefiling.gov.in.

– Click on the ‘Link Aadhaar’ option.

– Enter your PAN, Aadhaar number, and name as per Aadhaar in the relevant fields.

– Verify the details and submit.

– Upon successful linking, a confirmation message will be displayed on the screen, and an OTP will be sent to your registered mobile number.