In this article we are going to talk about SIM swapping, what is it and How we can prevent it?

We live in a technocratic world, and that is a fact none can negate.

With the extreme comfort that technology has bought, it has helped crime evolve and also has helped criminals to operate remotely and mostly anonymously.

This world has made crime and criminals safer.

Thus every day we hear about new types of cyber frauds and crimes.

One that has caught everyone’s attention is SIM swapping.

Through this technique, individuals have stolen thousands even crores from individual accounts.

Cybercriminals are becoming more and more accustomed to using the SIM swapping tool because it is efficient and simple.

This explains The Federal Bureau of Investigation receiving more than 1,600 SIM-swap complaints in 2021, the agency said, resulting in estimated losses of as much as $68 million.

Three years ago the numbers were 320 and estimated losses were $12 million.

That is quite a substantial jump.

What Is SIM Swapping?

Every phone has a SIM also known as a subscriber identity module.

Your SIM card is specific to you and is connected to your mobile account.

This small chip holds your phone number and account information can be removed from one device and placed in another.

SIM swapping, also known as SIM jacking or SIM hijacking, is a type of identity theft in which a thief takes your mobile phone number and puts it on a different SIM card.

How Does this Work?

They use this SIM to get access to your bank accounts and other sensitive information.

In most recent cases a cybercriminal gets a replica SIM card for a victim.

The thief must obtain a victim’s personal information, such as their email address, complete name, phone number, and other details, to clone a SIM card. They can do this by using standard phishing techniques.

The criminal uses this info and calls the mobile SIM operator, posing as the victim they will ask for a SIM replacement.

After the fraudsters have received this duplicate SIM they will be able to receive all OTPs and verification links, allowing them to withdraw a sizable sum of money without the target’s awareness.

If observe any Unusual activity in your email, social media or bank account you should get in touch with the mobile carrier company immediately for help.

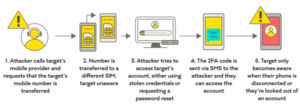

The Process of how the Scam takes place.

Credits:-Heimdal Securities

How Can You Prevent This From happening to you?

Enquire with your mobile operator if you have no network connectivity and you are not receiving any calls or SMSes for unusually long periods.

Do not neglect messages sent from your network provider that highlight a probable SIM-Swap. Remember to respond quickly to such messages.

Never switch off your smartphone in the event of you receiving numerous unknown calls. It could be a ploy to get you to turn off your phone and prevent you from noticing a tampered network connection.

Register for instant alerts (both SMS and Emails) that inform you of any activity in your bank account.

Check your bank statements frequently to identify irregularities.

Credits:- IT Explained and Wall Street Journal

Featured Image Credits:- Financial Express.